Total collections for December came in $6.9 million above estimate with personal income tax and sales tax up from last year.

However, collections for the 2020 fiscal year are still down about $33 million below estimates with a big shortfall in severance tax collections.

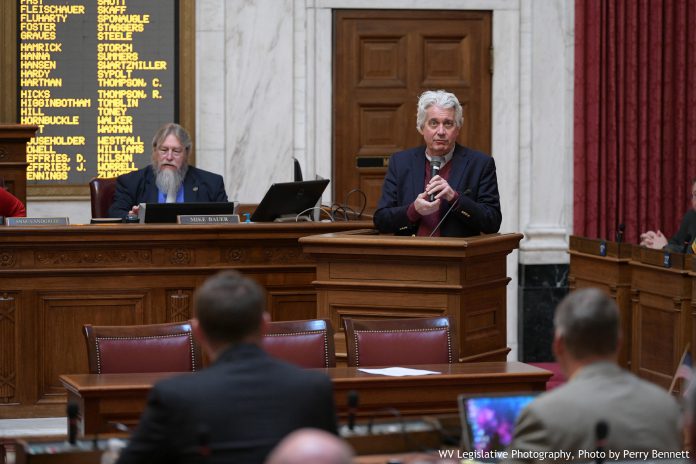

Revenue Secretary Dave Hardy presented December numbers to the Joint Standing Committee on Finance in its Monday morning meeting.

Cumulative personal income tax collections were about $33.6 million below estimate from last year and cumulative consumer sales tax collections were about $2.8 million below estimate from last year. However, cumulative collections for personal income tax were 1% ahead of last year and cumulative consumer sales tax was 1.6% above last year

“Consumer sales and personal income tax are in good shape,” Hardy said.

Last month, Hardy told the committee that numbers were improving, following a rough November. At that time, he told the committee there were no concrete plans for mid-year budget cuts. Personal income tax and sales tax were negatively affected in November due to timing but saw some growth starting in December.

December’s total collections came in at $428.2 million, which was 1.2% above last year, and $6.9 million above estimate.

Collections from July to December were $2.2 billion but about $33 million below estimates. Hardy said most of the shortfall was due to severance tax, which Hardy said was down 34.9% because of declines in natural gas prices and coal exports, along with pipeline construction shut down from federal court orders.

“Our report card is good but if we had severance tax where it could be, it would be an excellent report card,” Hardy said.

Corporate net income tax collections were about $2.6 million below estimates for December but relatively flat compared to last year.

Deputy Revenue Secretary Mark Muchow said tobacco tax collections benefited slightly from the carryover effect from November to December and were 1.9% ahead of last year. However, cumulative collections were 4% below last year. Muchow said the decline is estimated to continue because of people switching to other products such as e-cigarettes and also because of signed federal legislation, which increased the purchasing age from 18 to 21 years old.

The committee also heard a draft resolution regarding the business inventory tax. The proposed legislation would be a constitutional amendment, meaning voters would have to approve it. The resolution seeks to eliminate the tax on manufacturing inventory equipment. It would prohibit companies from reclassifying property not previously classified as manufacturing inventory just to receive the tax benefit.