The Senate passed six bills during today’s floor session, two of which completed legislation.

HB 2114 would update the meaning of “federal adjusted gross income” and certain other terms used in the West Virginia Personal Income Tax Act, and HB 2115 would updated the meaning of “federal taxable income” and certain other terms used in the West Virginia Corporation Net Income Tax Act. Both bills have now completed legislation.

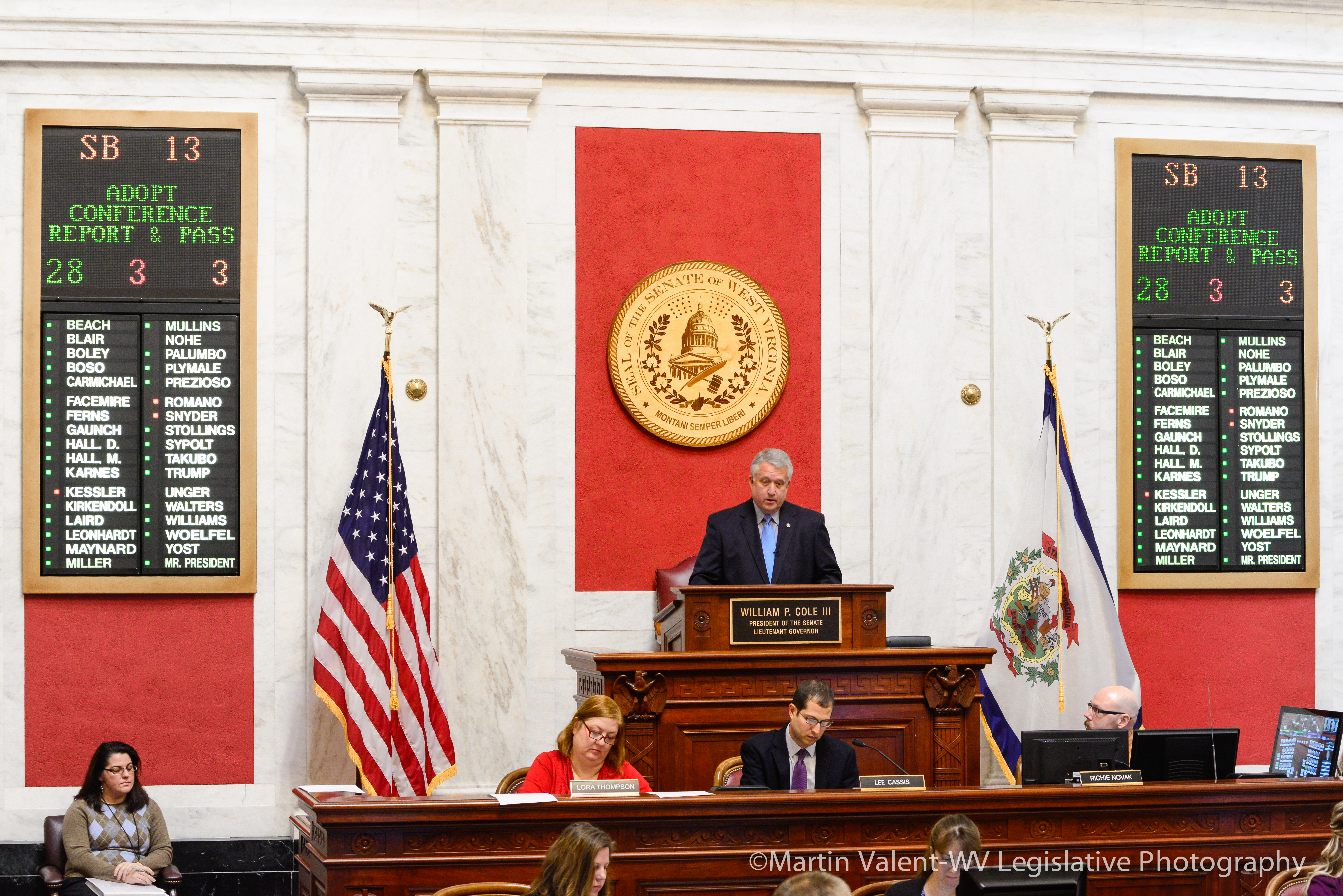

Senate Bill 13 was passed and made effective after the Senate adopted a conference committee report. SB 13 would reinstate open and obvious doctrine for premises liability. The Senate now asks the House to concur in their amendments.

Three other bills to pass included SB 382, SB 429, and SB 274. SB 382 relates to declaring claims against the state. SB 429 would allow one-day special charitable event licenses to sell non-intoxicating beer. SB 274 relates to TANF (Temporary Assistance to Needy Families) program sanctions.

Four bills on second reading were advanced to third. SB 277 and SB 286 were advanced, SB 421 was advanced with the right to amend, and HB 2004 was advanced with the adoption of an amendment.

Four bills on first reading were advanced to second including SB 266, SB 294, SB 412, and SB 42.

The Senate is adjourned until 11 a.m. tomorrow.

The following Senate committees will meet today:

Health at 1 p.m. in 451M.

Education at 2 p.m. in 451M.

Government Organization at 2 p.m. in 208W.

Judiciary at 3 p.m. in 208W.

The following Senate committees will meet tomorrow:

Transportation and Infrastructure at 9 a.m. in 451M.

Interstate Cooperation at 10 a.m. in 208W.

Natural Resources at 2 p.m. in 451M.

Pensions at 2 p.m. in 208W.